|

摘要:过去2个半月豆粕上涨1000-1100元/吨,华北玉米上涨了350-400元/吨,麦麸价格上涨了250元/吨。饲料原料全线上涨,吨饲料生产成本飙升了300-350元/吨,饲料加工毛利润锐减至正常水平,并且仍有下降趋势,行业经营难度增加,中短期可以充分利用当前下游养殖利润良好环境进行提价,但我们需要看到过去几年养殖产能扩张主要集中在大型养殖集团,大部分具有饲料生产能力,可供饲料企业市场空间下降,产能过剩压力,预计2016年下半年至2017年全年饲料加工行业兼并整合加快。

一、 我国饲料行业发展情况

1.1国内饲料行业发展总况

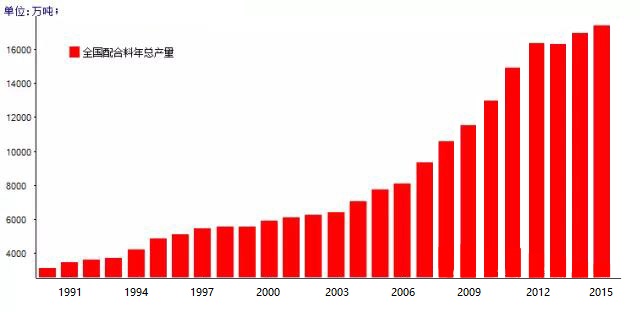

2015年全国商品饲料总产量20009万吨,同比增长1.4%。其中,配合饲料产量为17396.2万吨,同比增长2.7%;浓缩饲料产量为1960.5万吨,同比下降8.9%;添加剂预混合饲料产量为652.5万吨,同比增长1.9%。

配合饲料、浓缩饲料、添加剂预混合饲料产量占商品饲料总产量比重分别为86.9%、9.8%、3.3%,与上年比,配合饲料占总产量比重提高1.1个百分点,浓缩饲料下降1.1个百分点,添加剂预混合饲料提高0.1个百分点。配合饲料、浓缩饲料、添加剂预混合饲料三者比例为26.6:3.0:1,上年度为26.4:3.4:1。

截至2015年年末,全国饲料和饲料添加剂生产企业数量为13236家。其中,饲料添加剂(含混合型饲料添加剂)企业1691家,添加剂预混合饲料企业2747家,浓缩饲料、配合饲料和精料补充料企业6764家,单一饲料企业2034家。

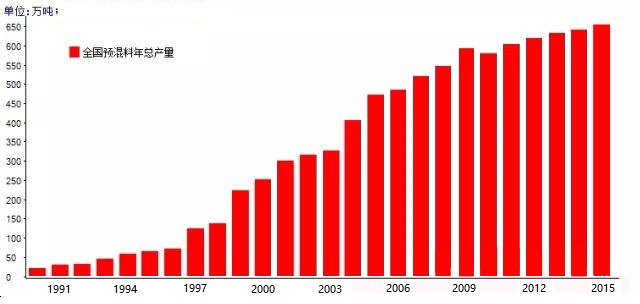

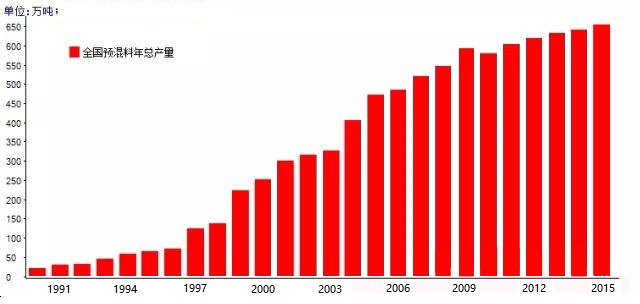

1.2 预混料行业发展情况

2015年,添加剂预混合饲料产量为652.5万吨,同比增长1.9%添加剂预混合饲料产量占商品饲料总产量比重分别为3.3%,与上年比,添加剂预混合饲料提高0.1个百分点。

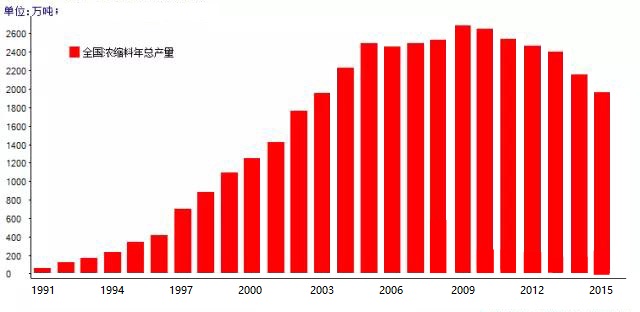

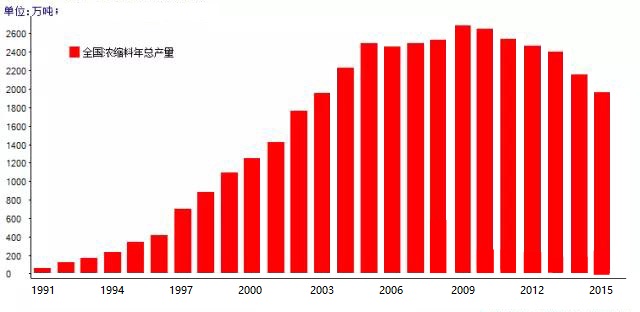

1.3浓缩料发展情况

2015年,全国浓缩料产量为为1960.5万吨,同比下降8.9%,浓缩饲料占商品饲料总产量比重分别为9.8%,与上年比,浓缩饲料下降1.1个百分点。

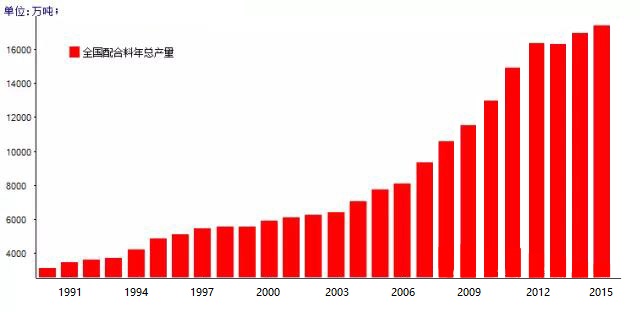

1.4配合料发展情况

2015年,全国配合饲料产量为17396.2万吨,同比增长2.7%,配合饲料占商品饲料总产量比重分别为86.9%,与上年比,配合饲料占总产量比重提高1.1个百分点

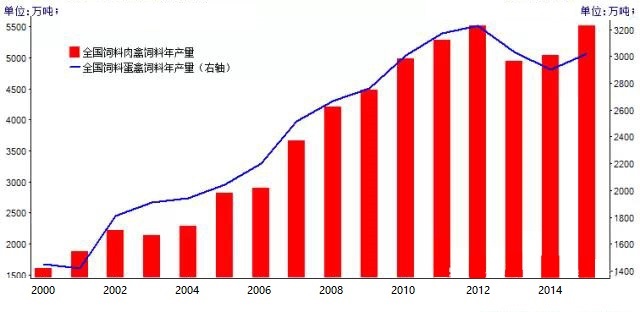

1.5分品种饲料发展情况

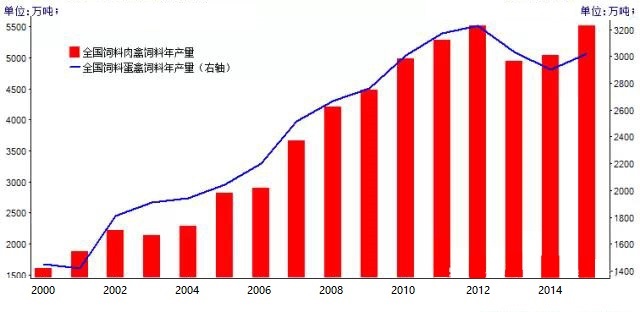

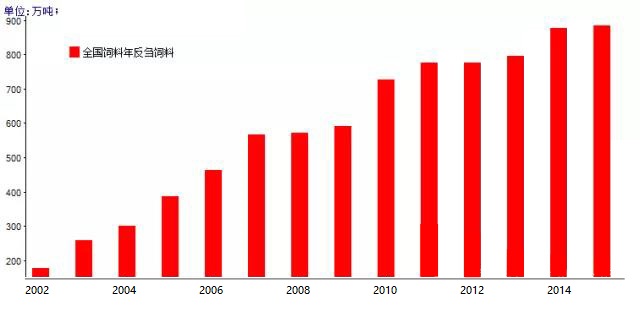

从品种总量看,2015年,猪饲料产量8343.6万吨,同比下降3.2%;蛋禽饲料产量3019.8万吨,同比增长4.1%;肉禽饲料产量5514.8万吨,同比增长9.6%;水产饲料产量1893.1万吨,同比下降0.5%;反刍动物饲料产量884.2万吨,同比增长0.9%;其他饲料产量353.7万吨,同比下降10.9%。

1.5.1猪料发展情况

2015年,猪饲料产量8343.6万吨,同比下降3.2%,2014年年末国内猪价复制了2013年末猪价下跌走势,下跌时间有所提前,元旦后,生猪养殖进入行业性亏损。仔猪价格较大猪提前下跌,2014年4季度母猪繁育逐步出现亏损,进入12月至春节期间母猪繁育理论亏损达到500-1000元/窝,实际亏损更大,养殖户淘汰母猪意愿增加,能繁母猪淘汰速度加快,母猪存栏量偏低,加上2015年整体环保政策偏紧,禁养政策以及南方水网整治工作导致整体产能恢复缓慢,官方数据至2015年年底,能繁母猪出现连续26个月下滑。2015年3季度生猪景气度提升,2016年上半年养殖压栏情况等,预计2016年猪料需求显著提升,产量也将出现5%左右增幅。

1.5.2肉、蛋禽料发展情况

2015年,蛋禽饲料产量3019.8万吨,同比增长4.1%。2015年,肉禽饲料产量5514.8万吨,同比增长9.6%。近几年禽料产量总体呈现下降主要由于禽流感影响了养殖户养殖意愿因素。

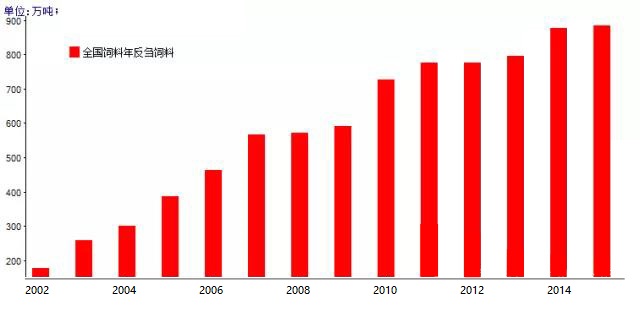

1.5.3反刍料

2015年,反刍动物饲料产量884.2万吨,同比增长0.9%。养殖行业整体呈现稳步增加,并有持续增加趋势。

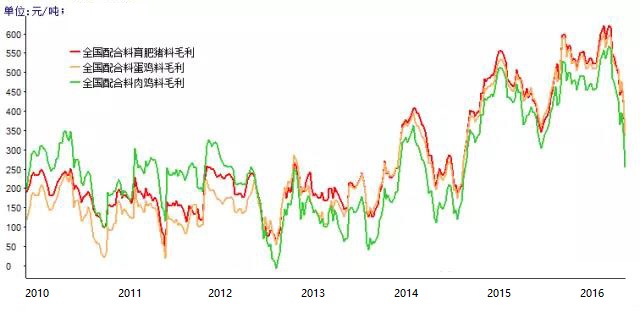

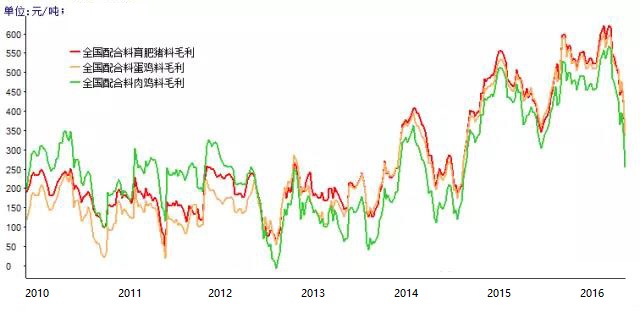

二、 2013年至今国内饲料行业加工毛利率变化

2013、4年中随着饲料原料价格整体走低,饲料价格逐步调低,特别进入2015年后,饲料价格多次调低,截止2016年初猪料及禽料价格普遍较2013年最高价下调近20%,但由于原料价格跌幅大于饲料价格跌幅,饲料加工毛利润大增。2016年4月份后随着豆粕价格快速反弹,华北玉米价格也强势上涨,短短2个月饲料加工利润暴跌了50%,回落到正常区间水平。

饲料原料成本压力,饲料厂短期可以通过提高饲料价格来对冲部分压力,但我们需要看到当前国内玉米库存虽高,然而基本集中在国家手里,后期玉米既然出现下滑,也难跌破前期低位。豆粕方面其他蛋白原料供应偏紧,南美大豆产量下降,支撑美豆上涨,国内饲料需求强势不排除后期豆粕价格继续上涨,进一步极大了饲料企业原料生产压力,挤压饲料厂生存空间。

三、 当前饲料行业发展瓶颈

2015年全国饲料工业总产值为7810亿元,同比增长2.7%。其中,商品饲料工业总产值7126亿元,同比增长2.7%;饲料添加剂总产值616亿元,同比增长3.6%;饲料机械设备总产值68亿元,同比增长1.4%。但我国饲料行业已成为我国重要的支柱产业值一。饲料行业整体行业仍面临着不少挑战,如饲料原料问题、饲料安全问题

分区域来看,2015年8个省份饲料产量过千万吨,8省饲料总产量为11744.9万吨,占全国饲料总产量58.7%,同比增长2.5%。其中,广东、山东饲料产量过两千万吨,分别达到2573.0万吨和2288.1万吨,2015年,七大经济带产量,华东地区(上海、江苏、浙江、安徽、福建、山东)饲料产量占全国饲料总产量26.1%,为七大区域之首。其次是华中地区(河南、湖北、湖南、江西)、华南地区(广东、海南、广西)占全国总产量比重分别为19.8%、19.2%。2015年国家实施更为严厉的环保政策,华南及华东地区养殖将受限,部分养殖场只能通过外迁,影响该地区饲料行业发展。

四、 行业并购机会

我国饲料加工产能过剩,整体行业开工了在50%,饲料行业技术水平较低,特别是配合料,企业研发能力较差,原料采购成本也存在明显差异,饲料原料强势上涨,市场份额缩小环境下,行业并购情况将出现,其中华南及华东地区并购增加,中部地区及西部地区企业新建产能也有望增加。

The English version

Abstract: in the past two and a half months rising soybean meal 1000-1100 yuan/ton, the north China corn rose by 350-400 yuan/ton, wheat bran prices rose 250 yuan/ton. Feed raw materials rose broadly, tons of feed production costs surged 300-350 yuan/ton, feed processing gross margin declined to normal levels, and there is still a downward trend, industry management difficulty increases, the short to medium term can make full use of current downstream breeding profit good environment for raising prices, but we need to see over the past few years breeding capacity expansion mainly concentrated in large breeding groups, most have feed production ability, to feed the enterprise market space, excess capacity pressures, is expected in the second half of 2016 to 2017, the year feed processing industry consolidation to speed up.

A, the feed industry development of our country

1.1 total domestic feed industry development

In 2015, the commercial feed production 200.09 million tons, up 1.4% from a year earlier. Among them, compound feed production is 173.962 million tons, up 2.7%; Concentrated feed production is 19.605 million tons, fell 8.9% year on year; Premixed feed additives production is 6.525 million tons, up 1.9% from a year earlier.

Compound feed, concentrated feed, premixed feed additives production goods feed production proportion of 86.9%, 9.8% and 3.3%, respectively, than with the previous year, compound feed proportion of total output increased by 1.1%, dropped 1.1%, and the concentrated feed additive premix feed increased by 0.1%. Compound feed, concentrated feed and additive premixed feed ratio is 26.6:3.0:1, the year of 26.4:3.4:1.

By the end of 2015, the national feed and feed additives production enterprise number for 13236. Among them, the feed additives (including mixed feed additive) enterprises, 1691, 2747 additive premix feed enterprises, concentrated feed, compound feed and concentrate 6764 supplementary material enterprises, 2034 single feed enterprises.

1.2 premix industry development

In 2015, premixed feed additives production is 6.525 million tons, up 1.9% year on year premixed feed additives production proportion of total goods feed production were 3.3%, than with the previous year, additive premix feed increased by 0.1%.

1.3 development concentrates 1.3 development concentrates

In 2015, the enrichment of material production to 19.605 million tons, down 8.9% year-on-year, concentrated feed proportion was 9.8%, total goods feed production than with the previous year, a 1.1% drop in concentrated feed.

1.4 cooperate with material development 1.4 cooperate with material development

In 2015, the compound feed production is 173.962 million tons, up 2.7% from a year earlier, compound feed proportion of total goods feed production were 86.9%, than with the previous year, compound feed proportion of total output increased by 1.1%

1.5 varieties feed development 1.5 varieties feed development

From the total varieties, 2015, 83.436 million tons of pig feed production, fell 3.2% year on year; Egg feed production 30.198 million tons, up 4.1%; Meat and poultry feed production 55.148 million tons, up 9.6%; Aquatic feed production 18.931 million tons, fell 0.5% year on year; Ruminant feed production 8.842 million tons, up 0.9%; Other feed production 3.537 million tons, fell 10.9% year on year.

1.5.1 pig feed development

In 2015, 83.436 million tons of pig feed production, fell 3.2% year on year, at the end of 2014, domestic prices copy at the end of 2013 prices fell, down time in advance, after the New Year's day, pig farming into an industry-wide losses. Piglets price large pig fell ahead of schedule, 4 quarter of 2014 sow breeding gradually loss, into the December to sow breeding theory losses during the Spring Festival of 500-1000 yuan/socket, the actual loss is bigger, the farmers are out of the sow will increase to numerous sows out faster, sow breeding stock is low, and in 2015 the overall environmental policy tight, ban policy and south water treatment cause the overall capacity recovery was slow, official data to the end of 2015, can appear numerous sows 26 consecutive month of decline. The boom of 3 quarter of 2015 pigs, breeding pressure bar, etc., in the first half of 2016 is expected to 2016 swine feeding significantly increased demand, production also will appear about 5% growth.

1.5.2 the material development of meat, egg

In 2015, egg feed production 30.198 million tons, up 4.1% from a year earlier. In 2015, meat and poultry feed production 55.148 million tons, up 9.6% from a year earlier. Poultry feed production in recent years, the overall decline in the main factors affecting the farmers breeding will due to bird flu.

1.5.3 ruminant material 1.5.3 ruminant material

In 2015, the ruminant feed production 8.842 million tons, up 0.9% from a year earlier. Aquaculture industry as a whole a steady increase, and the increasing trend.

2, 2013 to present domestic feed industry processing changes in gross margin 2, 2013 to present domestic feed industry processing changes in gross margin

2013, four years as feed raw materials prices overall fall, feed prices gradually lowered, especially into the 2015 years later, the feed prices down for many times, as of early 2016 pigs and poultry feed price is generally highest price cut nearly 20% in 2013, but due to the raw material price drop is greater than the feed prices drop, feed processing a huge increase in gross profit margin. In April 2016 as soybean meal prices rebound quickly, after the north China strong corn prices also rose, feed processing profits plunged 50% in just 2 months, back to normal range rate.

Short-term can feed the raw material cost pressure, feed mills to hedge some of this pressure by increasing feed prices, but we need to see the current domestic corn stocks are high, basic in state hands, however, since late corn fell, also hard to below the previous low. Other protein soybean meal of raw material supply tight, South American soybean production, support the beans rise, strong domestic demand for feed does not exclude the late soybean meal prices continue to rise, further greatly the raw material to produce feed enterprises pressure, extrusion feed mills living space. Short-term can feed the raw material cost pressure, feed mills to hedge some of this pressure by increasing feed prices, but we need to see the current domestic corn stocks are high, basic in state hands, however, since late corn fell, also hard to below the previous low. Other protein soybean meal of raw material supply tight, South American soybean production, support the beans rise, strong domestic demand for feed does not exclude the late soybean meal prices continue to rise, further greatly the raw material to produce feed enterprises pressure, extrusion feed mills living space.

Three, the current feed industry development bottleneck Three, the current feed industry development bottleneck

2015 national feed gross industrial output value is 781 billion yuan, up 2.7% from a year earlier. Among them, the commodity feed gross value of industrial output 712.6 billion yuan, up 2.7%; Feed additive output value 61.6 billion yuan, up 3.6%; Feed machinery equipment output value 6.8 billion yuan, up 1.4% from a year earlier. But China's feed industry has become an important pillar industry of the our country values a. Feed industry as a whole industry still faces many challenges, such as feed ingredients, feed safety problems points area, 2015, eight provinces feed production ten million tons, eight provinces of feed production is 117.449 million tons, accounting for 58.7% of total feed production, up 2.5% from a year earlier. Among them, guangdong, shandong feed production twenty million tons, 25.73 million tons and 25.73 million tons, in 2015, seven major economic belt production, in east China (Shanghai, jiangsu, zhejiang, anhui, fujian, shandong) feed production accounted for 26.1% of total feed production for first seven large area. Followed by the central China, henan, hubei, hunan, jiangxi), south China (guangdong, hainan, guangxi) accounts for the proportion of total output of 19.8%, 19.2% respectively. 2015 countries implement the tougher environmental policy, south China and east China will be limited, part of 12 only through farms, feed industry development in the region.

Four, industry m&a opportunities

Feed processing capacity in our country, the overall industry started at 50%, the feed industry technical level is low, especially, the batch of enterprise research and development ability is poorer, raw material procurement cost also exists obvious difference, feed raw materials strong gains, narrow market environment, industry mergers and acquisitions will appear, south China and east China mergers and acquisitions to increase, the central region and western region enterprises new capacity is expected to increase.

|